Goods and Services Tax GST Registration is easy and simple. Also known as Value Added Tax VAT in other countries GST is nothing new in this region.

Malaysia Sst Sales And Service Tax A Complete Guide

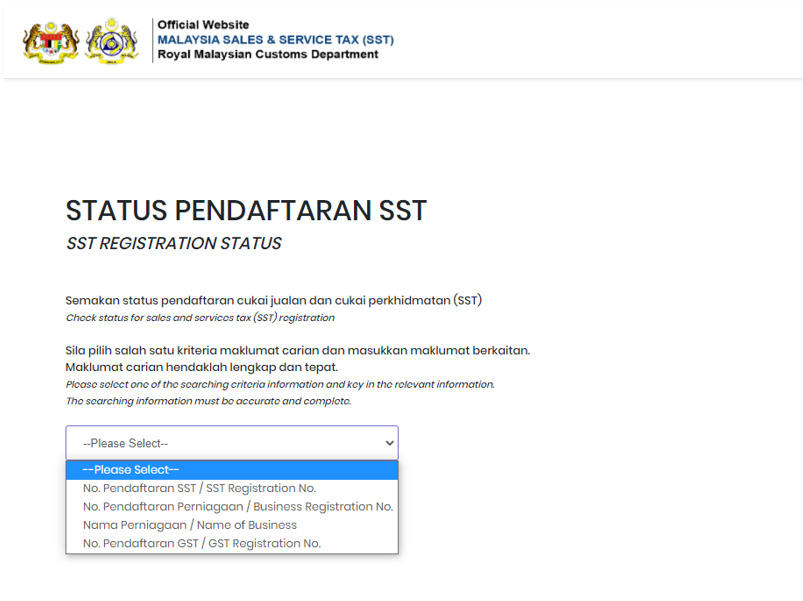

Minimum of first five characters of the business name is required.

. The GST charged by a company to its customers is known as output tax whereas GST paid by the company to its suppliers is called input tax. The standard goods and services tax GST in Malaysia is sales and service tax SST of 10. To ensure a smooth implementation of GST businesses are encouraged to submit their application for early registration.

Below are the available bulk discount rates for each individual item when you purchase a certain amount register as a premium educator at hbspharvardedu plan a course and save your students up to 50 with. RMCD is ready to. Then click on the Next button to go to the next stage.

From the suppliers perspective he will be entitled to a relief for bad debt if payment is not received within the same six month period and subject to meeting the qualifying conditions. Registering for the goods and services tax offers some significant advantages for businesses. As announced by the Government GST will be implemented on 1 April 2015.

The effective date of registration is on the first day of the following month after the end of the twenty-eight days liability. Why Register For The GST. Obtain a copy of the GST TAP website and click the Register for GST hyperlink.

This scheme which is called Margin Scheme to be applied only for goods motor vehicle only purchased from non-registered person and resold. Once youre registered for taxes youre expected to charge 6 GST on every sale to a Malaysian resident. Zero-Rated Supply Company If you are running business in Zero-Rated Supply category you do not need to charge 6 GST even though your companys yearly sales exceeds RM500000.

The two reduced SST rates are 6 and 5. The implementation of GST has changed the tax system in Malaysia. How can I get GST number in Malaysia.

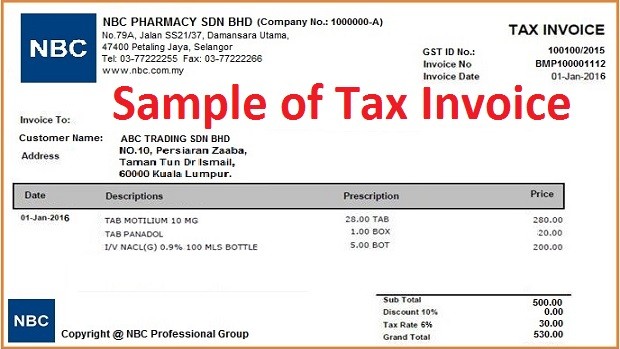

GST Registration Number GST Reg No Description. It replaced the Sales Tax and Service Tax systems in Malaysia. Collecting GST in Malaysia.

Sales and Service Tax SST Registration in Malaysia Compulsory SST Registration Manufacturers Services Provider who are GST Registered Persons which have been identified and fulfilled the required criteria will be registered automatically under the SST Registration as Registered Manufacturer under Sales Tax Registered Services Provider under Service Tax. Including the GST component in prices. Adalah dimaklumkan bahawa Portal MyGST ini tidak lagi dikemaskini semenjak GST dimansuhkan pada 31 Ogos 2018.

The Malaysia GST requires a GST-registered business which has made an input tax claim but fails to pay his supplier within six months from the date of supply to repay the input tax. GST is a multi-stage tax on domestic consumption. Sehubungan dengan itu sebarang pertanyaan dan maklumat lanjut berkaitan GST sila hubungi Pusat Panggilan Kastam 1-300-888-500 atau emailkan ke ccccustomsgovmy.

Guide on How to Register for GST in Malaysia Step by Step Instructions Details of the company or business the name of the company or business as well as contact information. GST is charged on all taxable supplies of goods and services in Malaysia except those goods and services that are explicitly exempted. When paying GST tax collected from customers can the Malaysia company offset the GST tax charged by its suppliers.

Private security officers work to protect a wide variety of business and residential clients. You must apply for GST registration within 28 days from the date the annual taxable turnover exceed RM500000 determined based on either the historical or the future method. Claim credits for GST for business related purchases.

A special GST treatment to allow businesses to charge and account GST on the positive price margin from the sales of the second-hand goods. If you are not anyone of the above you are required to register with Royal Malaysia Customs RMC and charge 6 GST to all your customers. Business under GST group divisional registration Sole proprietorships Reference number for GST matters M91234567X MR2345678A MB2345678A MX2345678A.

By imposing GST on the margin this scheme avoids the. Your company is required to register for GST and collect GST only if its annual turnover exceeds RM500000. GST registered companies should also ensure that the pricing of goods and services is at all.

TaxPayer Access Point Semakan Syarikat Berdaftar GST Berdasarkan Pendaftaran Syarikat Nama Syarikat atau Nombor GST Check For GST Registered Company By Company Registration Company name or GST Number Senarai Barangan Bercukai Tidak Bercukai List of Taxable Non-taxable Items. Alandalus property company registered news. Every registered business will have to file their sales and service tax return at the government portal.

It applies to most goods and services. The first reduced SST rate 6 applies to restaurants hotels and accommodation car hire rental and repair domestic flights insurance credit cards legal and accounting business consulting electricity. This registration is compulsory for business with a turnover over the threshold of RM500000 for a period of 12 months or less.

GST is also charged on the importation of goods and services into Malaysia. Goods and Services Tax GST Registration in Malaysia. Segala maklumat sedia ada adalah untuk rujukan sahaja.

The Malaysian government replaced GST with SST as of September 1 2018. GST on import of capital goods.

Everything You Need To Know On Gst Registration For Foreigners Ebizfiling

Everything About Gst Registration Of A Private Limited Company Ebizfiling

Step By Step Guide To Apply For Gst Registration

Goods And Services Tax Gst Malaysia For Manufacturing Sector

An Introduction To Malaysian Gst Asean Business News

Malaysia Gst Guide For Businesses

Do I Need To Register For Gst Goods And Services Tax In Malaysia

Do I Need To Register For Gst Goods And Services Tax In Malaysia

How To Start Gst Get Your Company Ready With Gst

Sales And Service Tax Sst In Malaysia Transitional From Gst To Sst 2 0

How To Start Gst Get Your Company Ready With Gst

Malaysia Sst Sales And Service Tax A Complete Guide

Malaysia Sst Sales And Service Tax A Complete Guide

Gst Change Of Address A Quick And Easy Online Process Ebizfiling

Step By Step Guide To Apply For Gst Registration

Step By Step Guide To Apply For Gst Registration

Step By Step Guide To Apply For Gst Registration